Beloved

Sethe, an escaped slave living in post-Civil War Ohio with her daughter and mother-in-law, is persistently haunted by the ghost of her dead baby girl.

DiMattia Building

1 Public Library Plaza

Stamford, CT 06904

United States

115 Vine Road

Stamford, CT 06905

United States

Lathon Wider Community Center

34 Woodland Avenue

Stamford, CT 06902

United States

1143 Hope Street

Stamford, CT 06907

United States

245 Selleck Street

Stamford, CT 06902

United States

United States

United States

United States

All Ferguson Library branches are closed today, Sunday, February 22, due to the winter storm.

Sethe, an escaped slave living in post-Civil War Ohio with her daughter and mother-in-law, is persistently haunted by the ghost of her dead baby girl.

Separated as girls, sisters Celie and Nettie sustain their loyalty to and hope in each other across time, distance, and silence.

In 1919, as civil and social unrest grips the country, there is a little corner of America, a place called Harlem where something special is stirring. Here, the New Negro is rising and Black pride is evident everywhere...in music, theatre, fashion and the arts. And there on stage in the center of this renaissance is Jessie Redmon Fauset, the new literary editor of the preeminent Negro magazine The Crisis. W.E.B. Du Bois, the founder and editor of The Crisis, has charged her with discovering young writers whose words will change the world. Jessie attacks the challenge with fervor, quickly finding sixteen-year-old Countee Cullen, seventeen-year-old Langston Hughes, and Nella Larsen, who becomes one of her best friends. Under Jessie's leadership, The Crisis thrives, the writers become notable and magazine subscriptions soar. Every Negro writer in the country wants their work published in the magazine now known for its groundbreaking poetry and short stories. Jessie's rising star is shining bright....but her relationship with W.E.B. could jeopardize all that she's built. The man, considered by most to be the leader of Black America, is not only Jessie's boss, he's her lover. And neither his wife, nor their fourteen-year-age difference can keep the two apart. Their torrid and tumultuous affair is complicated by a secret desire that Jessie harbors - to someday, herself, become the editor of the magazine, a position that only W.E.B. Du Bois has held. In the face of overwhelming sexism and racism, Jessie must balance her drive with her desires. However, as she strives to preserve her legacy, she'll discover the high cost of her unparalleled success.

A tightly bound Nigerian family living in Florida navigate wounds passed down from generation to generation.

From The Queen of Sugar Hill author ReShonda Tate - a new novel inspired by beloved Harlem jazz performer Hazel Scott and the equal parts exhilarating and tumultuous relationship that changed the course of her life.

From the two-time Emmy Award–winning producer and host of the Black and Published podcast comes a sweeping multi-generational epic following seven generations of Dupree women as they navigate love, loss, and the unyielding ties of family in the tradition of Homegoing and The Love Songs of W.E.B. DuBois.

At 40, Lena Baker is at a steady and stable moment in life--between wine nights with her two best friends and her wedding just weeks away, she's happy in love and in friendship until a confession on her wedding day shifts her world. Unmoored and grieving a major loss, Lena finds herself trying to teach her daughter self-love while struggling to do so herself. Lena questions everything she's learned about dating, friendship, and motherhood, and through it all, she works tirelessly to bring the oft-forgotten Black history of Oregon to the masses, sidestepping her well-meaning co-workers that don't understand that their good intentions are often offensive and hurtful. Through Watson's poetic voice, skin & bones is a stirring exploration of who society makes space for and is ultimately a story of heartbreak and healing.

In the stirring, highly anticipated first volume of his presidential memoirs, Barack Obama tells the story of his improbable odyssey from young man searching for his identity to leader of the free world, describing in strikingly personal detail both his political education and the landmark moments of the first term of his historic presidency--a time of dramatic transformation and turmoil.

In late August 1619, a ship arrived in the British colony of Virginia bearing a cargo of twenty to thirty people stolen from Africa. Their arrival led to the barbaric and unprecedented system of American chattel slavery that would last for the next 250 years. This is sometimes referred to as the country’s original sin, but it is more than that: It is the source of so much that still defines the United States.

Seldom does a book have the impact of Michelle Alexander's The New Jim Crow. Since it was first published in 2010, it has been cited in judicial decisions and has been adopted in campus-wide and community-wide reads; it helped inspire the creation of the Marshall Project and the new $100 million Art for Justice Fund; it has been the winner of numerous prizes, including the prestigious NAACP Image Award; and it has spent nearly 250 weeks on the New York Times bestseller list.Most important of all, it has spawned a whole generation of criminal justice reform activists and organizations motivated by Michelle Alexander's unforgettable argument that "we have not ended racial caste in America; we have merely redesigned it." As the Birmingham News proclaimed, it is "undoubtedly the most important book published in this century about the U.S."Now, ten years after it was first published, The New Press is proud to issue a tenth-anniversary edition with a new preface by Michelle Alexander that discusses the impact the book has had and the state of the criminal justice reform movement today.

A comprehensive overview of Tubman's life and work, co-authored by one of her descendants, Rita Daniels. For all Harriet Tubman's accomplishments and the myriad books written about her, many gaps, errors, and misconceptions of her legendary life persist. As recognitionand tributes to Tubman's remarkable contributions to American history and civil liberty continues to grow, the time is right for a new biography with the involvement of her family, who have been the caretakers and stewards of her legacy for generations.

In 1972, New York Representative Shirley Chisholm broke the ice in American politics when she became the first Black woman to run for president of the United States. Chisholm left behind a coalition-building model personified by a once-in-an-era Hollywood party hosted by legendary actress and singer Diahann Carroll, and attended by the likes of Huey P. Newton, Barbara Lee, Berry Gordy, David Frost, Flip Wilson, Goldie Hawn and others. In A More Perfect Party, MSNBC political analyst Juanita Tolliver presents a path to people-centered politics through the lens of this soiree, with surprising parallels to our current electoral reality.

The Martin Luther King Jr. of popular memory vanquished Jim Crow in the South. But in this myth-shattering book, award-winning and New York Times bestselling historian Jeanne Theoharis argues that King’s time in Boston, New York, Los Angeles, and Chicago—outside Dixie—was at the heart of his campaign for racial justice. King of the North follows King as he crisscrosses the country from the Northeast to the West Coast, challenging school segregation, police brutality, housing segregation, and job discrimination. For these efforts, he was relentlessly attacked by white liberals, the media, and the federal government.

The New York Times-bestselling, National Book Award-nominated author of The Love Songs of W.E.B. Du Bois and The Age of Phillis makes her nonfiction debut with this personal and thought-provoking work that explores the journeys and possibilities of Black women throughout American history and in contemporary times.

By following the lives of two Detroit grandfathers--one Black the other white--and their grandchildren, the author tells a riveting tale about racist policies, how they take root, why they flourish, and who profits.

A surprising and beautiful meditation on the color blue - and its fascinating role in Black history and culture - from National Book Award winner Imani Perry.

With this unflinching account, Justice Ketanji Brown Jackson invites readers into her life and world, tracing her family's ascent from segregation to her confirmation on America's highest court within the span of one generation. Named 'Ketanji Onyika,' meaning 'Lovely One,' based on a suggestion from her aunt, a Peace Corps worker stationed in West Africa, Justice Jackson learned from her educator parents to take pride in her heritage since birth. She describes her resolve as a young girl to honor this legacy and realize her dreams: from hearing stories of her grandparents and parents breaking barriers in the segregated South, to honing her voice in high school as an oratory champion and student body president, to graduating magna cum laude from Harvard, where she performed in musical theater and improv and participated in pivotal student organizations. Here, Justice Jackson pulls back the curtain, marrying the public record of her life with what is less known. She reveals what it takes to advance in the legal profession when most people in power don't look like you, and to reconcile a demanding career with the joys and sacrifices of marriage and motherhood. Through trials and triumphs, Justice Jackson's journey will resonate with dreamers everywhere, especially those who nourish outsized ambitions and refuse to be turned aside. This moving, openhearted tale will spread hope for a more just world, for generations to come.

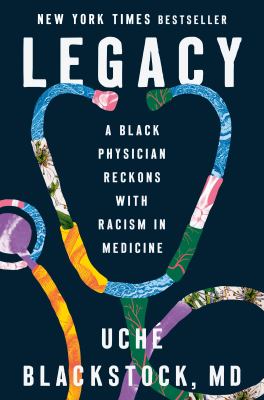

Part searing indictment of our healthcare system, part generational family memoir, part call to action, a physician and thought leader on bias and racism in healthcare recounts her journey to finally seizing her own power as a health equity advocate against the backdrop of the pandemic and the Black Lives Matter movement.

Midoriya's epic final battle with Shigaraki reaches its earth-shattering crescendo! With Danger Sense stolen away and the villain threatening to wipe Japan off the map, Midoriya has to get really creative with his Quirks to survive. The Second's plan to smash the vestiges of One For All into the core of Shigaraki's psychic space is the last chance the heroes have to stop All For One's grand schemes from coming to fruition. But first, Midoriya has to land a solid punch!

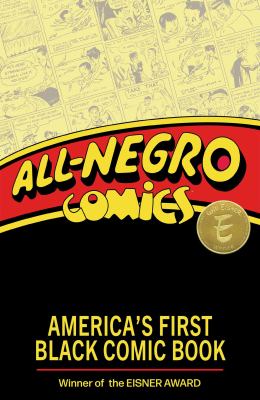

In 1947, groundbreaking journalist Orrin C. Evans assembled a team of Black cartoonists to publish All-Negro Comics, the first comic book created by Black artists for Black readers of all ages. Almost a century later, All-Negro Comics #1 is a little-known relic instead of an American heirloom like Action Comics #1, Marvel Comics #1, and other milestone comic books from the era. All-Negro Comics 75th Anniversary Edition preserves that history for generations to come, containing All-Negro Comics #1, in full and digitally remastered for clarity, several essays for historical context and con temporary reflection, as well as new stories by Black writers and artists of today, featuring the original characters.

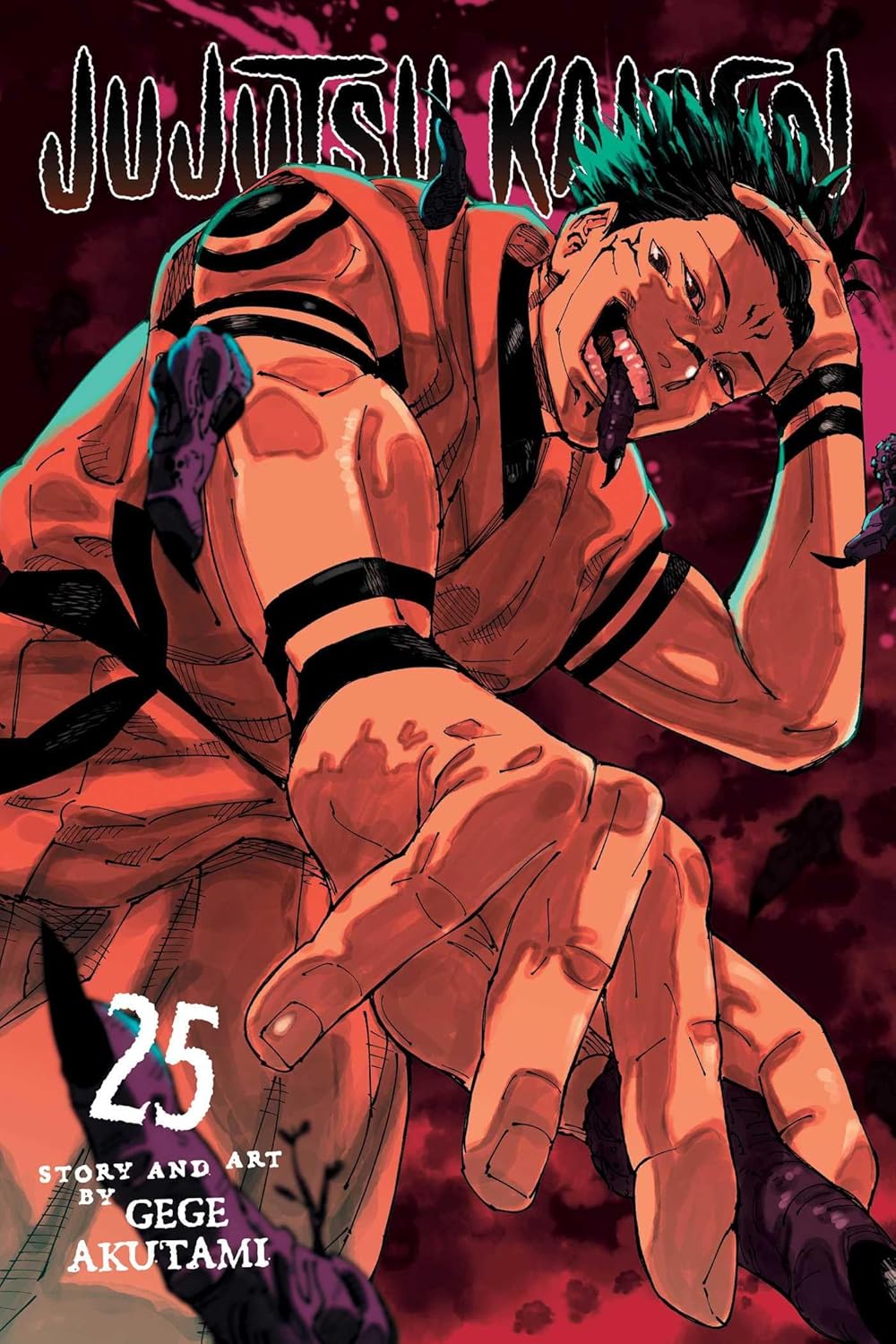

To gain the power he needs to save his friend from a cursed spirit, Yuji Itadori swallows a piece of a demon, only to find himself caught in the midst of a horrific war of the supernatural!

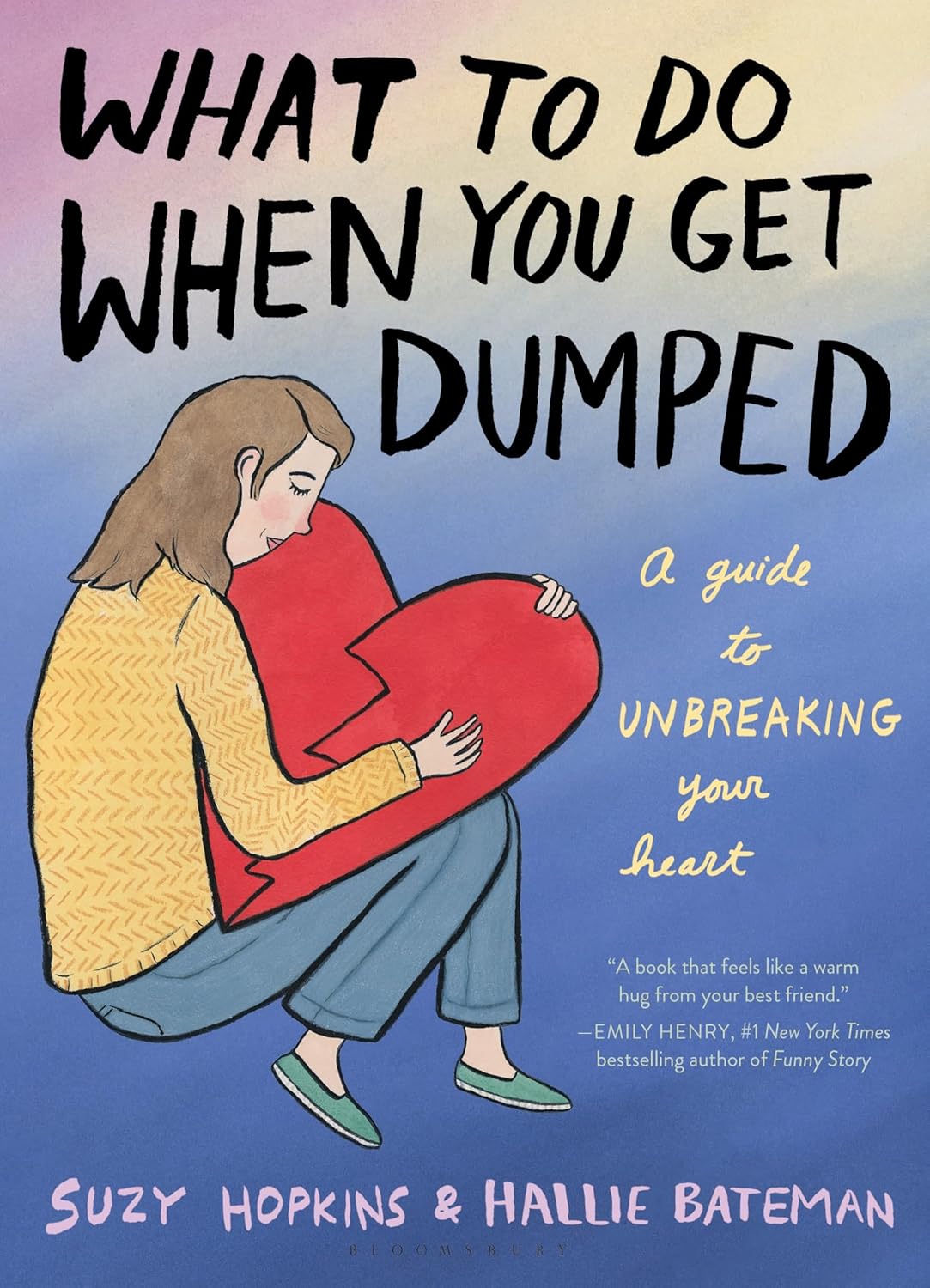

After Suzy Hopkins's husband of thirty years unexpectedly left her to pursue an old flame, her grief was so overwhelming that she thought her own heart might stop. How do you take the first step forward after losing such an integral part of your life?

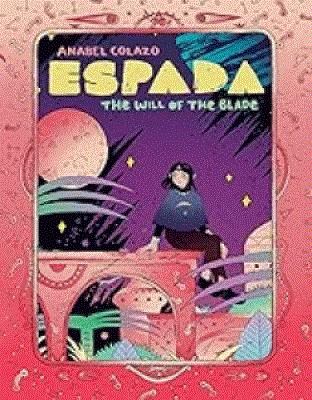

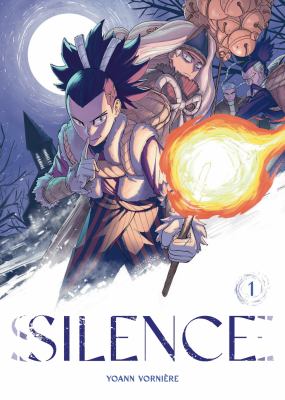

There was a time when everyone had access to magic, until a dispute for power attracted a demon from another world who destroyed everything--or so legend has it. However, there is another very different apocryphal version, according to which a hero, carrying a sword, came to the Kingdom to guide and protect its people. But who was that hero, and what became of him? Why is the queen now the only person capable of using magic? Attracted by all these enigmas of the past, Ania, princess of the Kingdom and heir to the throne by imposition, will try to find out the truth of these magical fables--now that she has just found a mysterious sword.

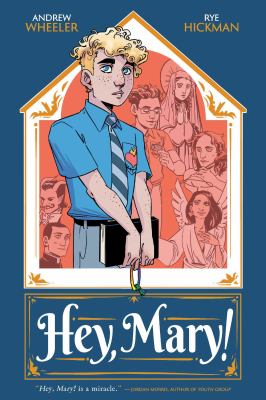

Mark is a good Catholic boy. He goes to church, says his prayers, and spends too much time worrying about hell. When Mark realizes he has a crush on another boy in his school, he struggles to reconcile his feelings with his faith as the weight of centuries of shame and judgment--and his fear of his parents' response--presses on his shoulders. Mark seeks advice from his priest, as well as a local drag performer, but also receives unexpected input from key figures in Catholic history and lore, including Joan of Arc, Michelangelo, St. Sebastian, and Savonarola. Ultimately, only Mark can answer the question: Is it possible for him to be both Catholic and gay?

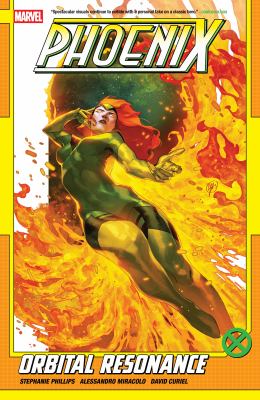

Jean Grey is the Phoenix once more, burning with power and possibility! She is Jean Grey. She is Phoenix. She fights for life. She brings death. One woman, alone in space, who not only must do what no one else can: She yearns to. And when a desperate S.O.S. from Nova brings the Phoenix to the edge of a black hole where hundreds of souls hang in the balance, Jean is dedicated to protecting innocents. But whatever she does - or fails to do - will bring darkness to the universe and haunt her in ways she can scarcely imagine! Plus: You'd think that with all of outer space as her playground, Jean would be safe from family dropping by without warning - but when your father-in-law is Corsair of the Starjammers, anything can happen! And Captain Marvel drops by just as Gorr the God Butcher seeks to slay the Phoenix!

Witness the birth of Wonder Woman's daughter! The mysteries surrounding Trinity's origins finally revealed and explored - but will the start of a new life mean the end of another one? And where does Wonder Woman's greatest love, Steve Trevor, fit into this new status quo? The war against the Sovereign is turning a dangerous corner and Steve Trevor must take matters into his own heads - but the consequences might prove deadly! Plus, when Trinity is born, how will Wonder Woman adjust to motherhood in the wake of so much tragedy and bloodshed? These questions and more explored as Tom King's Wonder Woman epic continues into its third volume, featuring art by fan-favorite artists Daniel Sampere and Khary Randolph.

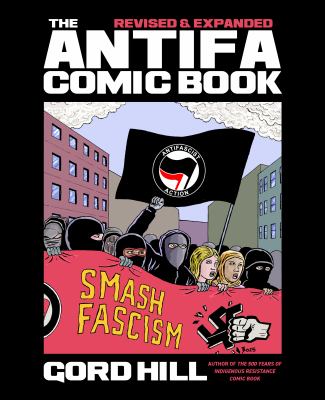

When it was first published in 2018, Gord Hill's The Antifa Comic Book was heralded for its searing imagery documenting the history of fascism and anti-fascist movements over the last century. In the years since its publication, the term "antifa" has been co-opted by the right to falsely describe far-left political extremism and even terrorism. But the role played by antifa movements in fighting fascism and racism around the world remains as relevant and important as ever. For this expanded edition, Gord Hill adds new material depicting more recent flashpoints of fascist activity, including the January 6, 2021, US Capitol attack, the murderous spree by Norwegian terrorist Anders Breivik, the infamous 2022 Canadian convoy protests, and Islamophobic and anti-migrant sentiment in a growing number of fascist governments in Europe. At the same time, Hill depicts the important work being done by anti-fascist individuals and organizations to combat this worrisome trend, made all the more crucial by Donald Trump's return to the White House.

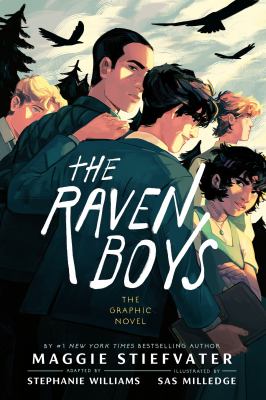

The first book in Maggie Stiefvater's #1 New York Times bestselling series The Raven Cycle, now gorgeously illustrated as a graphic novel! Blue Sargent comes from a family of psychics. Only, she has never had the same clairvoyant abilities they had and has always felt too ordinary within the magic that surrounded her. Enter Gansey, a rich student from Aglionby, the town's all-boys private school teeming with wealth, privilege, and trouble. Blue's always made it a point to stay away from its students, the Raven Boys. But when Gansey asks her to join him and three other Raven Boys on his quest to find a long-forgotten Welsh king rumored to be sleeping beneath the mountains of their quiet Virginia town, Blue doesn't hesitate. She jumps at the chance to finally be a part of something real and full of magic, a world she was born into yet one that always stood just out of reach. Soon enough, she's swept into a strange and shifting world woven into theirs, one far more dangerous than anything they could have dreamt up. Now reimagined as a stunning full-color graphic novel adapted by Stephanie Williams and illustrated by Sas Milledge, The Raven Boys unravels a thrilling plot around a cast of characters impossible to forget.

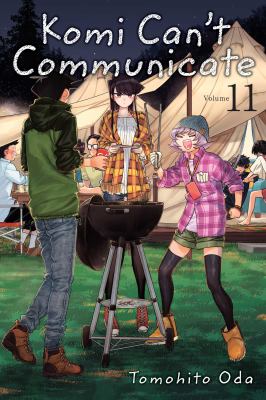

Socially anxious high school student Shoko Komi would love to make friends, but her shyness is interpreted as reserve, and the other students keep her at a distance. Only timid Tadano realizes the truth, and despite his own desire to blend in, he decides to help her achieve her goal of making 100 friends.

Our folklore is full of monsters that come out after dark. Ever since the sun disappeared behind ominous clouds, our world has been plunged into total darkness. We're out of supplies, and the creatures outside are multiplying and hunting us down. Our only chance of survival is to hide...in silence.

While Garfield is best known for his insatiable appetite for lasagna, he also believes in making time for bacon, and lots of it. Fans of the fat cat won't want to be disturbed as they happily devour this latest batch of scrumptious comics.

Rigsby, Wisconsin: it's just another nowhere town, but Bethany has finally found some stability here, far from the baleful, watching eyes of her oppressively disapproving mother. Jeordie and Erik are welcoming new friends, and even Anna seems happy to make her feel at home, despite hints of issues even bigger than hers. Amid the placid, scenic small-town beauty, the teens of Rigsby are roiling with struggles over what might come next, where to turn, and what's standing in their way. And when Bethany and Anna decide to go to the Homecoming dance together, the threads start to unravel.

In Marvel Animation's new series, we find Peter Parker still finding his footing on his journey to becoming the Spider-Man we all know and love! In this series, you can take the very first steps along with him as he discovers his powers, decides to become a hero, and even picks out his name and costume! Now Peter's gotta survive an entire Freshman year as a newbie crime-fighting vigilante…and if you think you know how this story goes, you are in for a surprise!

The best there is, by two of the finest around! Greg Capullo makes his grand return to Marvel Comics storytelling, teaming with top-tier writer Jonathan Hickman to pit Wolverine against a cadre of foes who will turn his world upside down! He's been beaten! He's been bloodied! But Logan only has one thought on his mind: revenge! Because the unspeakable has come to pass - and now Sabretooth, Omega Red, and Deadpool will pay! As Hickman and Capullo take Wolverine to the brink like never before, the path of vengeance he embarks on is a long and winding one - and you'll never guess where it leads!

The Harper and the Wells families have regarded each other with deep suspicion for four generations. The Harpers have been known to offer their psychic talents for less-than-legal purposes, and the powerful Wells clan has a reputation for playing both sides of the street. But for all the years of history and distrust between them, there is a mysterious pact binding the two. They share the responsibility for protecting a long-buried and very dangerous secret.

Inspired by the little known American tragedy near Nashville on July 9, 1918, when two passenger trains collided due to human error, this is the story of five men whose lives were intertwined that fateful day and the ripple effect of this forgotten tragedy on the woman who knew them all.

Andrew Fechmeier is a master at hiding. He'd better be—he’s spent decades concealing a secret that could get him killed. So when he’s diagnosed with a terminal disease, he heads for the local funeral home carrying the blue suit he eventually wants to be buried in. But what no one knows is that Fechmeier secretly tucked something inside, turning the suit into a final, untraceable hiding spot.

1664. Alouette Voland is the daughter of a master dyer at the famed Gobelin Tapestry Works, who secretly dreams of escaping her circumstances and creating her own masterpiece. When her father is unjustly imprisoned, Alouette's efforts to save him lead to her own confinement in the notorious Sal̂petrìere asylum, where thousands of women are held captive and cruelly treated. But within its grim walls, she discovers a small group of brave allies, and the possibility of a life bigger than she ever imagined. 1939. Kristof Larson is a medical student beginning his psychiatric residency in Paris, whose neighbors on the Rue de Gobelins are a Jewish family who have fled Poland. When Nazi forces descend on the city, Kristof becomes their only hope for survival, even as his work as a doctor is jeopardized.

Miami criminal defense lawyer Jack Swyteck must contend with a unique problem. His client, Elliott Stafford, indicted for murder, has gone silent. Not just silent in asserting his Fifth Amendment right against self-incrimination—Elliott refuses to speak. He won’t talk to the judge, his girlfriend, or even the attorney fighting for his life. There seems to be no medical or psychological reason for his silence. He has, as Jack puts it, “chosen to become his own worst enemy.”

The human “oddities” in the Museum of the Strange are less wondrous than the gawking rubes had been promised. But Alida is something else. The real thing. Traveling Depression-era America from carnival midways to speakeasies, Alida is resigned to an exploited and lonely life on the road as the museum’s golden ticket. Until she’s rescued by two compassionate strangers.

Simone St. James, the New York Times bestselling author of The Sun Down Motel, returns with her scariest, most shocking novel yet in this pulse-pounding story about siblings who return to the house they fled 18 years before, called back by the ghost of their long-missing brother and his haunting request: Come home. Strange things happen in Fell, New York. A mysterious drowning at the town's roadside motel. The unexplained death of a young girl whose body is left by the railroad tracks. For the Esmie siblings--Violet, Vail, and Dodie--the final straw was the shocking disappearance of their little brother. It started as a normal game of hide-and-seek. The three closed their eyes and counted to ten while Ben went to hide. But this time, they never found their brother--he was gone and the ongoing search efforts turned up no clues. As their parents grew increasingly distant, Violet, Vail, and Dodie were each haunted by visions and frightening events that made them leave town and never look back. Violet still sees dead people--spirits who remind her of Sister, the menacing presence that terrorized her for years. And now after two decades running from their past, it's time for a homecoming. Because Ben is back, and he's ready to lead them to the answers they've longed for and long feared. If the ghosts of Fell don't get to them first. A Box Full of Darkness is another propulsive thriller from the author of The Broken Girls and The Book of Cold Cases, a surprising horror story from a writer who is "particularly gifted at doling out twists.

Five years after her husband Owen disappeared, Hannah Hall and her stepdaughter Bailey have settled into a new life in Southern California. Together, they've forged a relationship with Bailey's grandfather Nicholas and are putting the past behind them. But when Owen shows up at Hannah's new exhibition, she knows that she and Bailey are in danger again. Hannah and Bailey are forced to go on the run in a relentless race to keep their past from catching up with them. As a thrilling drama unfolds, Hannah risks everything to get Bailey to safety--and finds there just might be a way back to Owen and their long-awaited second chance.

It's the mid-1980s in the tiny town of Longview, Texas. Nellie Anderson, the beautiful daughter of the Anderson family dynasty, has burst onto the scene. She always gets what she wants. What she can't get for herself… well, that's what her mother is for. Because Charleigh Andersen, blond, beautiful, and ruthlessly cunning, remembers all too well having to claw her way to the top. When she was coming of age on the poor side of East Texas, she was a loser, an outcast, humiliated, and shunned by the in-crowd, whose approval she'd so desperately thirsted for. When a prairie-kissed family moves to town, all trad wife, woodworking dad, wholesome daughter vibes, Charleigh's entire self-made social empire threatens to crumble.

After being fired for taking an uncharacteristic risk at her commodities trading job, Bea Macon sublets her New York apartment and books a one-way ticket to stay with her mother, Christy, a free spirit who has been living in Salt Lake City on Bea's dime.

Lilian ("Lily") Delaney, apprentice to a master bookbinder in Oxford in 1901, chafes at the confines of her life. She is trapped between the oppressiveness of her father’s failing bookshop and still being an apprentice in a man’s profession. But when she’s given a burned book during a visit to a collector, she finds, hidden beneath the binding, a fifty-year-old letter speaking of love, fortune, and murder.

Joni Ackerman was tired of being invisible. It's been five years since Joni Ackerman tipped the antifreeze into her husband's cocktail. Five years since he was found dead at the bottom of the stairs. Five years since she got away with murder. At first, Joni feared the consequences of her transgression, but she's learned to embrace the power of recklessness in a way she would have hated to see in anyone else. It was that recklessness, after all, that took her to this rewarding new life. Joni now runs Sunny Day Productions alongside her daughter, Chris, and her best friend, Val. All is well in life and work until, one day, their balance is rocked when an unexpected, and unwelcome, visitor appears. When Joni's brother, Marc, resurfaces after a twenty-year estrangement, Joni braces for the sibling she knew -- a cruel, vindictive conman who deftly switched between personas. But this Marc on her doorstep is different. He's older, softer. And he seems to have overcome the self-inflicted traumas of his past. But Val isn't fooled. She knows exactly what sort of man Marc is, and she warns Joni to keep her guard up. When Mark inevitably betrays Joni's trust, Joni is forced to look inward. As dark thoughts, and darker compulsions, take form, Joni can't help but wonder: "Is psychopathy a family trait?" Katia Lief's Women Like Us is a sharply rendered literary thriller that examines the complexities and responsibilities of female friendship -- what brings women together, and what drives them apart.

It starts with the destruction of a US Coast Guard cutter and the loss of her entire crew. But the USCG Claiborne was on an innocuous mission to open a sea lane between an oil field off the coast of Guyana and the refineries of southern Louisiana. The destruction of the ship, tragic as it is, won't stop that mission from continuing. So who would sacrifice twenty-two men and women just to slow down the plan? That's the question plaguing Jack Ryan Jr. He's in Guyana to work a deal to get his company, Hendley Associates, in on the ground floor of this new discovery, but the destruction of the Claiborne and the kidnapping of the Guyanese Interior Minister make it clear that there's a malignant force working to destroy Guyana's oil industry. It's up to Jack to identify the killers before they draw a bead on him, but how can he do that when the line of demarcation between friend and foe is constantly shifting?

A richly imagined novel of the Austen family by the #1 International bestselling-author of Miss Austen. It is a truth universally acknowledged that a single man in possession of a good fortune must be in want of a wife. 1820. Mary Dorothea Knatchbull is living under the sole charge of her widowed father, Sir Edward - a man of strict principles and high Christian values. But when her father marries Miss Fanny Knight of Godmersham Park, Mary's life is suddenly changed. Her new stepmother comes from a large, happy and sociable family and Fanny's sisters become Mary's first friends. Her aunt, Miss Cassandra Austen of Chawton, is especially kind. Her brothers are not only amusing, but handsome and charming. And as Mary Dorothea starts to bloom into a beautiful young woman, she forms an especial bond with one Mr Knight in particular. Soon, they are deeply in love and determined to marry. They expect no opposition. After all, each is from a good family and has known the other for some years. It promises to be the most perfect match. Who would want to stand in their way?

A priest is murdered and a private agent is the number one suspect. Jack Morgan is in Rome celebrating the opening of a new local Private office, when the party takes a deadly turn. Private agent Matteo Ricci is found at the party standing over the body of a dead priest with a gun in hand, swearing he did not kill the man. As Jack tries to prove Matteo's innocence, he uncovers a much deadlier conspiracy - which leads him straight to the heart of the Vatican. With corruption closing in on all sides, Jack must decide who he can trust before the city falls.

Everyone at Chantilly’s Bar noticed out-of-towner Camille Bayliss. Red lips, designer heels, sipping a Negroni. But that woman wasn’t Camille Bayliss. It was Aubrey Price. Camille Bayliss appears to have the picture-perfect life; she’s married to hotshot lawyer Ben and is the daughter of a wealthy Louisiana family. Only nothing is as it seems: Camille believes Ben has been hiding dirty secrets for years, but she can’t find proof because he tracks her every move.

Deep underground, thirty-nine women live imprisoned in a cage. Watched over by guards, the women have no memory of how they got there, no notion of time, and only a vague recollection of their lives before. As the burn of electric light merges day into night and numberless years pass, a young girl--the fortieth prisoner--sits alone and outcast in the corner. Soon she will show herself to be the key to the others' escape and survival in the strange world that awaits them above ground. Jacqueline Harpman was born in Etterbeek, Belgium, in 1929, and fled to Casablanca with her family during WWII. Informed by her background as a psychoanalyst and her youth in exile, I Who Have Never Known Men is a haunting, heartbreaking post-apocalyptic novel of female friendship and intimacy, and the lengths people will go to maintain their humanity in the face of devastation. Back in print for the first time since 1997, Harpman's modern classic is an important addition to the growing canon of feminist speculative literature.

St. Medard’s Bay, Alabama is famous for three things: the deadly hurricanes that regularly sweep into town, the Rosalie Inn, a century-old hotel that’s survived every one of those storms, and Lo Bailey, the local girl infamously accused of the murder of her lover, political scion Landon Fitzroy, during Hurricane Marie in 1984.

When Geneva Corliss, the current owner of the Rosalie Inn, hears a writer is coming to town to research the crime that put St. Medard’s Bay on the map, she’s less interested in solving a whodunnit than in how a successful true crime book might help the struggling inn’s bottom line. But to her surprise, August Fletcher doesn’t come to St. Medard’s Bay alone. With him is none other than Lo Bailey herself. Lo says she’s returned to her hometown to clear her name once and for all, but the closer Geneva gets to both Lo and August, the more she wonders if Lo is actually back to settle old scores.

As the summer heats up and another monster storm begins twisting its way towards St. Medard’s Bay, Geneva learns that some people can be just as destructive―and as deadly―as any hurricane, and that the truth of what happened to Landon Fitzroy may not be the only secret Lo is keeping.

Cassie Linden worries about every word she can't remember, terrified of the early-onset Alzheimer's that stole her mother. Now, recently divorced, she's back home to care for her aging father, who can no longer manage his beloved bees. To pay for her dad's care, she puts her misgivings aside and convinces him to sell to a developer who's putting up a luxury project next door. She also enlists the help of beekeeper Glenn Marsden, who fiercely opposes development of this last open space in town. Glenn hasn't had much to say to women ever since his wife left him and their young daughter eight years ago, but something unexpected has sparked with Cassie.

On the evening of July 4th, a young woman scatters her mother's ashes in New York and follows the call of the changing winds to the French coastal city of Marseille. For the first time in her life, Vianne feels in control of her future. Charming her way into a job as a waitress, she tries to fit in, make friends, and come to terms with her pregnancy, knowing that by the time her child is born, the turning wind will have changed once again. As she discovers the joy of cooking for the very first time, making local recipes her own with the addition of bittersweet chocolate spices, she learns that this humble magic has the power to unlock secrets. And yet her gift comes at a price. And Vianne has a secret of her own; a secret that threatens everything.

For the first time in print, Skin and Bones features a collection of eight gripping original short stories in the bestselling Mike Bowditch series--including one brand new, never-before-published story--from Edgar-award nominated author Paul Doiron. In The bear trap, legendary Maine woodsman and bush pilot Charley Stevens tries to convince young Mike of the dangers awaiting rookie game wardens. Rabid draws Mike into the story of a gruesome case involving a bat with rabies from his Charley Steven's past (2019 Edgar award nominee for Best Short Story). When a visiting hunter goes missing in the middle of a snowstorm, a young Charley Stevens sets off to rescue him-but begins to suspect the man may not want to be found in Backtrack. In The imposter, Mike isconfronted with a baffling case of stolen identity when he discovers a dead body whose driver's license claims he is none other than Mike Bowditch himself. Mike tracks down a sinister prowler who turns a couple's dream vacation home into a nightmare in The cartekaer. An investigation into the killing of a bald eagle in Skin and bones unearths an old case of a missing young man whose physically abusive brother might have murdered him. In Snakebit, Mike must hunt down a killer who uses the unlikeliest of murder weapons: rattlesnakes.

There are places on earth where nature’s powers gather. Girls raised there are bequeathed strange gifts. A few have powers so dark that they fear to use them. Such a place is Wild Hill, on the tip of Long Island. For centuries, the ghost of a witch murdered by colonists claimed the beautiful and fertile Wild Hill…until a young Scottish woman with strange gifts arrived. Sadie Duncan was allowed to stay.

First—a Baltimore coffee shop. A seat in the corner, facing the door. Black coffee, two refills, no messing around. A minor interruption from two of the customers, but nothing he can’t deal with swiftly. As he leaves, a young guy brushes against him in the doorway. Instinctively Reacher checks the pocket holding his cash and passport. There’s no problem. Nothing is missing.

Saeris Fane doesn’t want power. The very last thing she needs is her name whispered on an entire court’s lips, but now that she’s been crowned queen of the Blood Court, she’s discovering that a queen’s life is not her own. A heavy weight rests upon her shoulders. Her ward—and her brother—need her back in her homeland…but the changes that have strengthened Saeris have also made her weak. Born under blazing suns, Saeris will surely die if she makes her way home through the Quicksilver. Which means that, once again, she must send someone else in her stead...

A woman invited to her wealthy fiance's family retreat realizes they are hiding a terrible secret - and that she's been there before.

Joyride by Susan Orlean is a memoir that blends personal reflection with insights from her celebrated career in narrative nonfiction. Orlean recounts her life as a writer driven by curiosity, exploring diverse subjects from everyday life to extraordinary experiences. The book offers practical advice on creativity and the craft of writing--idea generation, deadlines, interviewing, and overcoming self-doubt--while tracing her personal journey through professional milestones, marriage, motherhood, and loss. Set against the backdrop of a changing media landscape, Joyride is both a portrait of a writer's evolution and an ode to living a curious, creative life.

In the 1970s, an unprecedented wave of international terrorism broke out around the world. More ambitious, networked and far-reaching than ever before, new armed groups terrorized the West with intricately planned plane hijackings and hostage missions, leaving governments scrambling to cope. Their motives were as diverse as their methods. Some sought to champion Palestinian liberation, others to topple Western imperialism or battle capitalism; a few simply sought adventure or power. Among them were the unflappable young Leila Khaled, sporting jewelry made from AK-47 ammunition; the maverick Carlos the Jackal with his taste for cigars, fine dining, and designer suits; and the radical leftists of the Baader-Meinhof Gang or the Japanese Red Army. Their attacks forged a lawless new battlefield thirty thousand feet in the air, evading the reach of security agencies, policymakers, and spies alike. Their operations rallied activist and networks in places where few had suspected their existence, leaving a trail of chaos from Bangkok to Paris to London to Washington, D.C.

In March 2020, Belle Burden was safe and secure with her family at their house on Martha’s Vineyard, navigating the early days of the pandemic together—building fires in the late afternoons, drinking whisky sours, making roast chicken. Then, with no warning or explanation, her husband of twenty years announced that he was leaving her. Overnight, her caring, steady partner became a man she hardly recognized. He exited his life with her like an actor shrugging off a costume.

One of the most famous figures in Christian history, Francis of Assisi (1181/82-1226) was revered as a miracle worker during his life and quickly canonized after his death. He has inspired generations of Christians and other spiritual seekers, from medieval ascetics to 1960s hippies and modern environmentalists. The "poverello" wrote poems praising the sun, moon, and stars, spoke to the birds, and--so the story goes--even tamed a wolf. But what do we know for sure about who he was, and what is simply legend? Drawing on centuries of scholarship, Volker Leppin pieces together fragments of Francis's life story to find a seeker who never reached his destination, a man whose extraordinary charisma drew others in yet who was uncomfortable in the spotlight. Amazingly, Francis stayed within the fold of the church while offering a new and radical vision of Christianity that proved wildly popular. Leppin's Francis of Assisi sets Francis's inner emotional and spiritual world against a broader historical background to show how the message of this inspiring and often vexing medieval saint continues to resonate in our contemporary world.

We. Do. Not. Care. Hop aboard the Hot Mess Express, Sisters, and welcome to the club! Do you wake up with night sweats at 3:26 a.m., overstimulated, mad at anything breathing, and ready to put the world on notice? Do you forget the words you are saying as you are saying them? If you have a she-shed and no longer care about clothes that fit or cellulite on your legs (legs is legs!), then welcome to the club--the We Do Not Care Club (WDNC). You're now a card-carrying member with an exclusive invite to the biggest hormonal party in town. This club is for all of our Sisters in perimenopause, menopause, and postƯmenopause who are over it.

For nearly seven decades, Mattel billed Barbie as the first adult doll—a revolutionary alternative to the baby dolls before her, which had treated little girls as future mothers rather than future women. But Barbie was no original. She was a knockoff: a nearly identical copy of a German doll now erased from the narrative in favor of Mattel’s preferred version of history. It was Barbie’s first secret but far from her last.

How do you steal a library? Not just any library but the most secret, heavily guarded archive in the world. The answer is to be a librarian. To be so quiet, that no-one knows what you are up to as you toil undercover and deep amongst the files. The work goes on for decades but remains so low key, that even after your escape, aided by MI6, no-one even notices you are gone.

From the critically acclaimed author of The Invention of Murder, an extraordinary, revelatory portrait of everyday life on the streets of Dickens' London.The nineteenth century was a time of unprecedented change, and nowhere was this more apparent than London. In only a few decades, the capital grew from a compact Regency town into a sprawling metropolis of 6.5 million inhabitants, the largest city the world had ever seen. Technology--railways, street-lighting, and sewers--transformed both the city and the experience of city-living, as London expanded in every direction. Now Judith Flanders, one of Britain's foremost social historians, explores the world portrayed so vividly in Dickens' novels, showing life on the streets of London in colorful, fascinating detail.From the moment Charles Dickens, the century's best-loved English novelist and London's greatest observer, arrived in the city in 1822, he obsessively walked its streets, recording its pleasures, curiosities and cruelties. Now, with him, Judith Flanders leads us through the markets, transport systems, sewers, rivers, slums, alleys, cemeteries, gin palaces, chop-houses and entertainment emporia of Dickens' London, to reveal the Victorian capital in all its variety, vibrancy, and squalor. From the colorful cries of street-sellers to the uncomfortable reality of travel by omnibus, to the many uses for the body parts of dead horses and the unimaginably grueling working days of hawker children, no detail is too small, or too strange. No one who reads Judith Flanders's meticulously researched, captivatingly written The Victorian City will ever view London in the same light again.

Samin Nosrat has always had a complicated relationship with recipes. How, she wondered, can a recipe be anything more than a snapshot-an attempt to define the undefinable? How can ever it capture the feeling of experiencing something in person? In Good Things, she makes peace with this paradox, offering more than 125 of her favorite recipes-simply put, the things she most loves to cook for herself and for friends-and infusing them with all the beauty and care you would expect from Samin Nosrat. As she says, "Once I hand them off to you, they are no longer mine. They're yours, to do with as you please. And maybe, in the act of receiving, a little thread of connection will be woven between me and each of you." Good Things is an essential, joyful guide to cooking and living, whether you're looking for a comforting, creamy tomato soup to console a struggling friend, seeking a deeper sense of connection in your life, or hosting a dinner for ten in your too-small dining room. Here you'll find go-to recipes for ricotta custard pancakes, chicken braised with apricots and harissa, a crunch, tingly Calabrian chili crisp, super-chewy sky-high focaccia, and a decades-in-the-making, childhood-evoking yellow cake. Along the way, you'll also find plenty of tips, techniques, and lessons from the person Alice Waters called "America's next great cooking teacher," from how to buy olive oil (check the harvest date) to when to splurge (salad dressing is where you want to use your best ingredients) to the one acceptable substitute for Parmigiano Reggiano (Grana Padano, if you must).

An "oral history of a band that came to define a generation, [this book] tells the madcap story of Paul McCartney and his newly formed band, from their humble beginnings in the early 1970s to their dissolution barely a decade later. Drawn from over 500,000 words of interviews with McCartney, family and band members, and other key participants, Wings recounts--now with a half-century's wisdom--the musical odyssey taken by a man searching for his identity in the aftermath of The Beatles' breakup. Soon joined by his wife--American photographer Linda McCartney--on keyboard and vocals, drummer Denny Seiwell, and guitarist Denny Laine, McCartney sowed the seeds for a new band that would later provide the soundtrack of the decade. Organized chronologically around McCartney, RAM, and nine Wings albums, the narrative begins when a twenty-seven-year-old superstar, rumored to be dead, fled with his new wife to a remote sheep farm in Scotland amida sea of legal and personal rows. Despite the harsh conditions, theScottish setting gave McCartney time to create, and it was here where this new band emerged.

A narrative account of the twentieth president's political career offers insight into his background as a scholar and Civil War hero, his battles against the corrupt establishment, and Alexander Graham Bell's failed attempt to save him from an assassin's bullet.

From #1 New York Times bestselling author and beloved former Today co-host Hoda Kotb comes her most personal, ambitious book yet-a guide to dealing with change and upheaval, even (and perhaps especially) when it's unexpected. Hoda Kotb didn't expect to join the Today show at age forty-four. Or to become a mother at fifty-two. Or to leave Today and embark on a new adventure at sixty! Change doesn't always arrive when we expect it, and its effects are anything but predictable. But Hoda believes that the benefits of change can be extraordinary...if we're willing to listen to and learn from them. In the tradition of books like Savannah Guthrie's Mostly What God Does and Maria Shriver's I've Been Thinking comes Hoda Kotb's Jump and Find Joy-an intimate book that reveals for the first time what Hoda discovered as she started embracing change in every aspect of her life. In her quest to better understand change and how to work with (not against) it, Hoda relies on her reporting instincts to investigate HOW change works, WHO is approaching it with grace, and WHAT she can apply to her own life and share with others. Jump and Find Joy combines the wisdom of change experts, insights from the latest work on resilience, and deeply personal stories from celebrities and inspirational people in our own communities. From small shifts in daily routines to major leaps of faith, Hoda shows why change isn't to be feared but celebrated...and how each of us can thrive in the midst of changes we'll inevitably face ourselves.

Every day we are confronted with: sudden pivots at our workplace and in the job market, rule-changing technology such as Artificial Intelligence, unexpected crises and a culture of chaos, the sinking feeling that we are losing control of our lives. This is the book about taking back control. It's easy to follow and easy to turn into lifelong habits. It has been thoroughly researched and examined. Simply put, Disrupt Everything works. One question. Are you ready to Disrupt Everything and take control of your future?

Nikki Giovanni's extraordinary final collection - a landmark of American literature - speaks to the fury of our current political moment while reflecting on the tragedies and triumphs of her early life

The body is the most complex machine in the world, and the only one for which you cannot get a replacement part from the manufacturer. For centuries, medicine has reached for what's available -- sculpting noses from brass, borrowing skin from frogs and hearts from pigs, crafting eye parts from jet canopies and breasts from petroleum by-products. Today we're attempting to grow body parts from scratch using stem cells and 3D printers. How are we doing? Are we there yet? In Replaceable You, Mary Roach explores the remarkable advances and difficult questions prompted by the human body's failings. When and how does a person decide they'd be better off with a prosthetic than their existing limb? Can a donated heart be made to beat forever? Can an intestine provide a workable substitute for a vagina? Roach dives in with her characteristic verve and infectious wit. Her travels take her to the OR at a legendary burn unit in Boston, a 'superclean' xeno-pigsty in China, and a stem cell 'hair nursery' in the San Diego tech hub. She talks with researchers and surgeons, amputees and ostomates, printers of kidneys and designers of wearable organs. She spends time in a working iron lung from the 1950s, stays up all night with recovery techs as they disassemble and reassemble a tissue donor, and travels across Mongolia with the cataract surgeons of Orbis International. Irrepressible and accessible, Replaceable You immerses readers in the wondrous, improbable, and surreal quest to build a new you.

A legendary football coach shares a comprehensive philosophy for success, drawing from his decades of experience in sports to offer principles on leadership, motivation, growth and decision-making that can be applied to any field or profession.

Are you one of the 52 million people who experience chronic pain in your day-to-day life? In It Doesn’t Have to Hurt, Sanjay Gupta makes the empowering argument that there are effective options for relief that you can start practicing today to greatly reduce your chances of suffering pain tomorrow.

Film historian and acclaimed New York Times bestselling biographer Scott Eyman has written the definitive biography of Hollywood icon Joan Crawford, drawing on never-before-seen documents and photos from the Crawford estate. Joan Crawford burst out of her poverty-stricken youth to become a bright young movie star in the 1920's, drawing the admiration of F. Scott Fitzgerald and the attention of audiences worldwide. She flourished for decades, working for multiple studios in every genre from romance to westerns (Mildred Pierce, Johnny Guitar), musicals to noir (Torch Song, A Woman's Face), and being directed by a young Steven Spielberg in one of her last appearances. Along the way she accumulated four husbands, an Academy Award for Best Actress, and the undeniable status of a legend. Joan Crawford: A Woman's Face looks at the reality of this remarkable woman through the prism of groundbreaking primary research, interviews with friends and relatives, and with the same insightful analysis of character and motive that author Scott Eyman brought to John Wayne and Cary Grant, among others. Joan Crawford was a woman like no other, and Joan Crawford: A Woman's Face is the first full telling of her dazzling, turbulent life.

No other phenomenon has shaped human history as decisively as capitalism. It structures how we live and work, how we think about ourselves and others, how we organize our politics. Sven Beckert, author of the Bancroft Prize–winning Empire of Cotton, places the story of capitalism within the largest conceivable geographical and historical framework, tracing its history during the past millennium and across the world. An epic achievement, his book takes us into merchant businesses in Aden and car factories in Turin, onto the terrifyingly violent sugar plantations in Barbados, and within the world of women workers in textile factories in today’s Cambodia.

Theodore Roosevelt was one of America’s most fascinating presidents—a complex man both publicly and privately. In this sweeping biography, historian David S. Brown takes us on an electrifying journey through Theodore Roosevelt’s life—from his privileged New York upbringing to his transformative presidency that reshaped America’s role on the global stage.

Elyse Myers is known to her twelve million followers as “The Internet’s Best Friend,” sharing her relatable stories and comedic sketches and serving as an advocate for topics such as neurodivergence, impostor syndrome, body image, and more. Whether she’s making people laugh with tales of disastrous dates or giving a voice to that awkward internal monologue many of us have, she has three simple goals behind everything she makes: To make people feel known, loved, and like they belong.

If you'd like to sample the library's collection of movies on Blu-Ray, now you don't have to buy a Blu-Ray player to do so!

Lifting the Chains is a history of the Black experience in America since the Civil War, told by one of our most

distinguished historians of modern America, William H. Chafe. He argues that, despite the wishes and arguments of many whites to the contrary, the struggle for freedom has been carried out primarily by Black Americans, with only occasional assistance from whites. Chafe highlights the role of all-black institutions--especially the churches, lodges, local gangs, neighborhood women's groups, and the Black college clubs that gathered at local pool halls--that talked up the issues, examined different courses of action, and then put their lives on the line to make change happen.

The story begins in 1619—a year before the Mayflower—when the White Lion disgorges “some 20-and-odd Negroes” onto the shores of Virginia, inaugurating the African presence in what would become the United States. It takes us to the present, when African Americans, descendants of those on the White Lion and a thousand other routes to this country, continue a journey defined by inhuman oppression, visionary struggles, stunning achievements, and millions of ordinary lives passing through extraordinary history.

An epic biography of Malcolm X finally emerges, drawing on hundreds of hours of the author's interviews, rewriting much of the known narrative. Les Payne, the renowned Pulitzer Prize-winning investigative journalist, embarked in 1990 on a nearly thirty-year-long quest to interview anyone he could find who had actually known Malcolm X-all living siblings of the Malcolm Little family, classmates, street friends, cellmates, Nation of Islam figures, FBI moles and cops, and political leaders around the world. His goal was ambitious: to transform what would become over a hundred hours of interviews into an unprecedented portrait of Malcolm X, one that would separate fact from fiction. The result is this historic biography that conjures a never-before-seen world of its protagonist, a work whose title is inspired by a phrase Malcolm X used when he saw his Hartford followers stir with purpose, as if the dead were truly arising, to overcome the obstacles of racism.

Using history as a foundation, The Humanity Archive uses storytelling techniques to make history come alive and uncover the truth behind America's whitewashed history. Challenging dominant perspectives, author Jermaine Fowler goes outside the textbooks to find recognizably human stories. Connecting current issues with the heroic struggles of those who have come before us, Fowler brings hidden history to light.

An award-winning broadcaster and educator presents his experiences following the path of African Americans who traveled the country during the age of segregation using The Green Book, a guide which helped Black people travel safely.

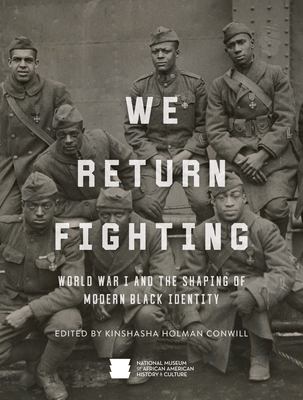

A richly illustrated commemoration of African Americans' roles in World War I highlighting how the wartime experience reshaped their lives and their communities after they returned home.

In this beautifully written masterwork, Pulitzer Prize–winning author Isabel Wilkerson presents a definitive and dramatic account of one of the great untold stories of American history: the Great Migration of six million Black citizens who fled the South for the North and West in search of a better life, from World War I to 1970.

How do we talk about Black history and racism in the United States on college campuses? In a series of essays, Professor Leonard Moore outlines how he has taught courses on African American history at colleges with a largely white student body. As an African American professor, he has had to find ways to teach to a diverse classroom, but one that is often dominated by white students with little prior knowledge of this history. Moore discusses how his love of history and drive to teach have emerged from his own experiences, and how those experiences have also shaped how he approaches the oft-challenging task of teaching history. He also discusses how racism and bias are ingrained in the African American experience throughout US history.

The Martin Luther King Jr. of popular memory vanquished Jim Crow in the South. But in this myth-shattering book, award-winning and New York Times bestselling historian Jeanne Theoharis argues that King’s time in Boston, New York, Los Angeles, and Chicago—outside Dixie—was at the heart of his campaign for racial justice. King of the North follows King as he crisscrosses the country from the Northeast to the West Coast, challenging school segregation, police brutality, housing segregation, and job discrimination. For these efforts, he was relentlessly attacked by white liberals, the media, and the federal government.

In this highly anticipated follow-up to Eyes on the Prize, bestselling author Juan Williams turns his attention to the rise of a new 21st-century civil rights movement. More than a century of civil rights activism reached a mountaintop with the arrival of a Black man in the Oval Office. But hopes for a unified, post-racial America were deflated when Barack Obama's presidency met with furious opposition. A white, right-wing backlash was brewing, and a volcanic new movement--a second civil rights movement--began to erupt. In New Prize for These Eyes, award-winning author Juan Williams shines a light on this historic, new movement. Who are its heroes? Where is it headed?

The author, examines the significance of Black history and its role in education. Drawing on his experiences as a lifelong learner and classroom teacher, Jones explores topics such as the American Revolution, the concepts of race and nation, and the importance of historical inquiry. Through personal reflection and narrative, he emphasizes the value of understanding collective history and encourages readers to engage thoughtfully with the past.

After an encounter with a skunk, Dog Man, now scarlet red after being dunked in tomato juice, is exiled but must find a way to save those who shunned him when an all-new, never-before-seen villain unleashes an army of A.I. robots.

Rescued from the outrageous neglect of his aunt and uncle, a young boy with a great destiny proves his worth while attending Hogwarts School for Witchcraft and Wizardry.

Greg Heffley is caught in the middle as the two halves of his extended family come together in a sidesplittingly relatable summer story! When the Heffley's agree to spend summer break with both Mom's and Dad's relatives at the same time, they have to figure out how to be in two places at once. With Greg caught in the middle, can the Heffley's pull off the ultimate scheme? Or will their vacation turn into a hilarious hot mess?

After learning that the father he never knew is Poseidon, God of the Sea, Percy Jackson is transferred from boarding school to Camp Half-Blood, a summer camp for demigods, and becomes involved in a quest to prevent a war between the gods.

In Big Shot, book 16 of the Diary of a Wimpy Kid series from #1 international bestselling author Jeff Kinney, Greg Heffley and sports just don't mix. After a disastrous field day competition at school, Greg decides, that when it comes to his athletic career, he's officially retired. But, after his mom urges him to give sports one more chance, he reluctantly agrees to sign up for basketball. Tryouts are a mess, and Greg is sure he won't make the cut. But, he unexpectedly lands a spot on the worst team. As Greg and his new teammates start the season, their chances of winning even a single game look slim. But, in sports, anything can happen. When everything is on the line and the ball is in Greg's hands, will he rise to the occasion? Or, will he blow his big shot?

DOG MAN IS BACK! The highly anticipated new graphic novel in the #1 worldwide bestselling series starring everyone's favorite canine superhero by award-winning author and illustrator Dav Pilkey! Piggy has returned, and his newest plot is his most diabolical yet. WHAT other new villains are on the horizon? WHERE are they all coming from? And WHO will step forward to save the city when scoundrels sabotage our Supa Buddies? With themes of friendship and doing good, Dog Man: Twenty Thousand Fleas Under the Sea is packed with action and hilarity. Featuring "Chomp-O-Rama," a brand-new song, a monstrous Mighty Mite -- and so much more than ever before! IT'S HEROIC, IT'S EPIC! For more creative, heartfelt adventures, join Flippy and Li'l Petey in the Cat Kid Comic Club series. And don't forget the series that started it all: Captain Underpants! A new edition of The Adventures of Captain Underpants includes a brand new Dog Man comic!

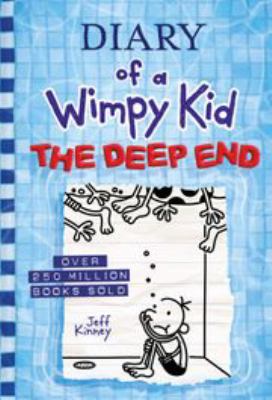

In The Deep End, book 15 of the Diary of a Wimpy Kid series from #1 international bestselling author Jeff Kinney, Greg Heffley and his family hit the road for a cross-country camping trip, †‹ready for the adventure of a lifetime. But things take an unexpected turn, and they find themselves stranded at an RV park that's not exactly a summertime paradise. When the skies open up and the water starts to rise, the Heffleys wonder if they can save their vacation-or if they're already in too deep. And don't miss Rowley Jefferson's Awesome Friendly Adventure, an all-new fantasy from Greg's best friend-the follow-up to the instant #1 bestseller Diary of an Awesome Friendly Kid: Rowley Jefferson's Journal. Jeff Kinney is the #1 USA Today, New York Times, and Wall Street Journal bestselling author of the Diary of a Wimpy Kid series and a six-time Nickelodeon Kids' Choice Award winner for Favorite Book. The Meltdown, book 13, was published in October 2018, and was a #1 bestselling book. His latest book, Diary of an Awesome Friendly Kid: Rowley Jefferson's Journal, was published in April 2019. Jeff has been named one of Time magazine's 100 Most Influential People in the World. He is also the creator of Poptropica, which was named one of Time's 50 Best Websites. He spent his childhood in the Washington, D.C., area and moved to New England in 1995. Jeff lives with his wife and two sons in Massachusetts, where they own a bookstore, An Unlikely Story.